Automating Signals that Work in Your Specific Market

AI x GTM Summit → Session #5 with Soham Maniar

If you were forwarded this newsletter, join 6,256 weekly readers—some of the smartest GTM founders and operators—by subscribing here:

Thanks to the companies that made the AI x GTM Summit possible! (+stats/notable attendees)

Automating Signals That Work in Your Specific Market

The Alpha Is in the Niche Signals

Publicly available, third-party signals are becoming commoditized.

Job postings, website visits, LinkedIn engagement. Everyone’s tracking these now. They’re better than nothing, but the real alpha is in niche signals.

At the AI x GTM Summit, Soham Maniar (a modern RevOps ninja) shared what actually works in signal-based selling. Soham is one of those RevOps people who makes the job feel creative and fun while still being rigorous. He’s currently at Nominal.io and has built signal engines at companies like Weaviate and others.

Our conversation covered how to think about signals, where the real value is, and how to operationalize all of this without drowning in noise.

Here’s what we covered:

Setting the stage: TAM → ICP → SBM

AI-enabled company tiering (custom ICP)

The three-circle overlap (ICP + engagement + readiness)

Niche signals are the alpha (plus real examples)

Timing matters more than copy

How to find the right signals for your business

Who owns this? (RevOps, GTM engineering, SDR leaders)

Operationalizing signals without creating noise

Follow Soham on LinkedIn! He’s a legend.

[Suggested Spotify playlist while reading this series]

IYMI:

Session #1 → Sorting the World into your CRM (GTM gold is stuck in your top seller’s brain: How to extract + operationalize it) || YouTube video of Matthew and Andreas’ full session (22 mins)

Session #2 → Infrastructure for agentic GTM: data stack, orchestration, and activation || YouTube video of Nico’s full session (23 mins)

Session #3 → Getting agents deployed into your GTM systems: pitfalls, opportunities, and best practices || YouTube video of Joe’s full session (19 mins)

Session #4 → Nuanced Viewpoint on AI-Generated Outbound Email Copy | YouTube video of full session (22 mins)

Alright, let’s get into it.

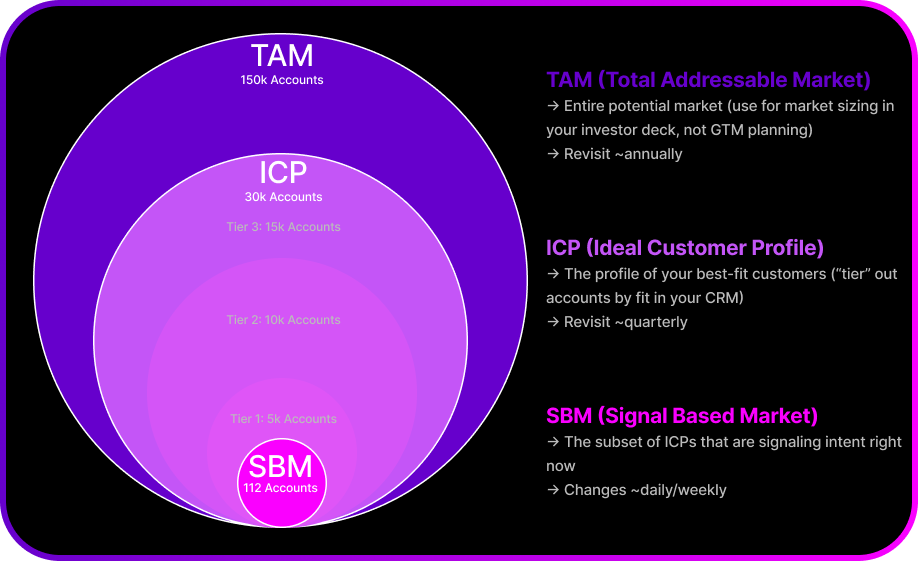

Setting the stage: TAM → ICP → SBM

I opened this session with a framework that I use to think about targeting. The “signal-based market” are a small set of accounts that are the most likely to respond and have a sales conversation if you reach out to them today.

TAM (Total Addressable Market) is your entire potential market. Use this for market sizing in your investor deck, not for GTM planning. Revisit ~annually.

ICP (Ideal Customer Profile) is the profile of your best-fit customers. Tier accounts by fit in your CRM. Revisit ~quarterly.

SBM (Signal Based Market) is the subset of your ICP that’s signaling intent right now. This changes daily or ~weekly.

Here’s how the numbers might look:

TAM: 150,000 accounts

ICP: 30,000 accounts (Tier 1: 5k, Tier 2: 10k, Tier 3: 15k)

SBM: 112 accounts (today)

Those 112 accounts are the ones most likely to take a sales meeting with you today. You’re not blasting all 30,000 accounts every week. You’re using signals to identify which ones to reach out to and when.

AI-enabled company tiering (custom ICP)

Before you can identify signals, you need to know what a good account looks like.

The smartest GTM teams are moving beyond basic firmographic data. And using AI agents to find “rich” data points—stuff that’s specific to your business, not the same attributes everyone else is using.

Why:

Basic firmographics (industry, employee count, revenue) are commoditized

AI can find custom data points that actually correlate with your best customers

How:

Enrich accounts with AI workflows

Use bespoke data points in a scoring formula

Automate company-fit scoring so it runs forever—every new account gets tiered automatically

The output of this system tags Accounts in your CRM with High fit, Medium fit, Low fit, Unqualified (or Tier 1, 2, 3). Then, you layer signals on top.

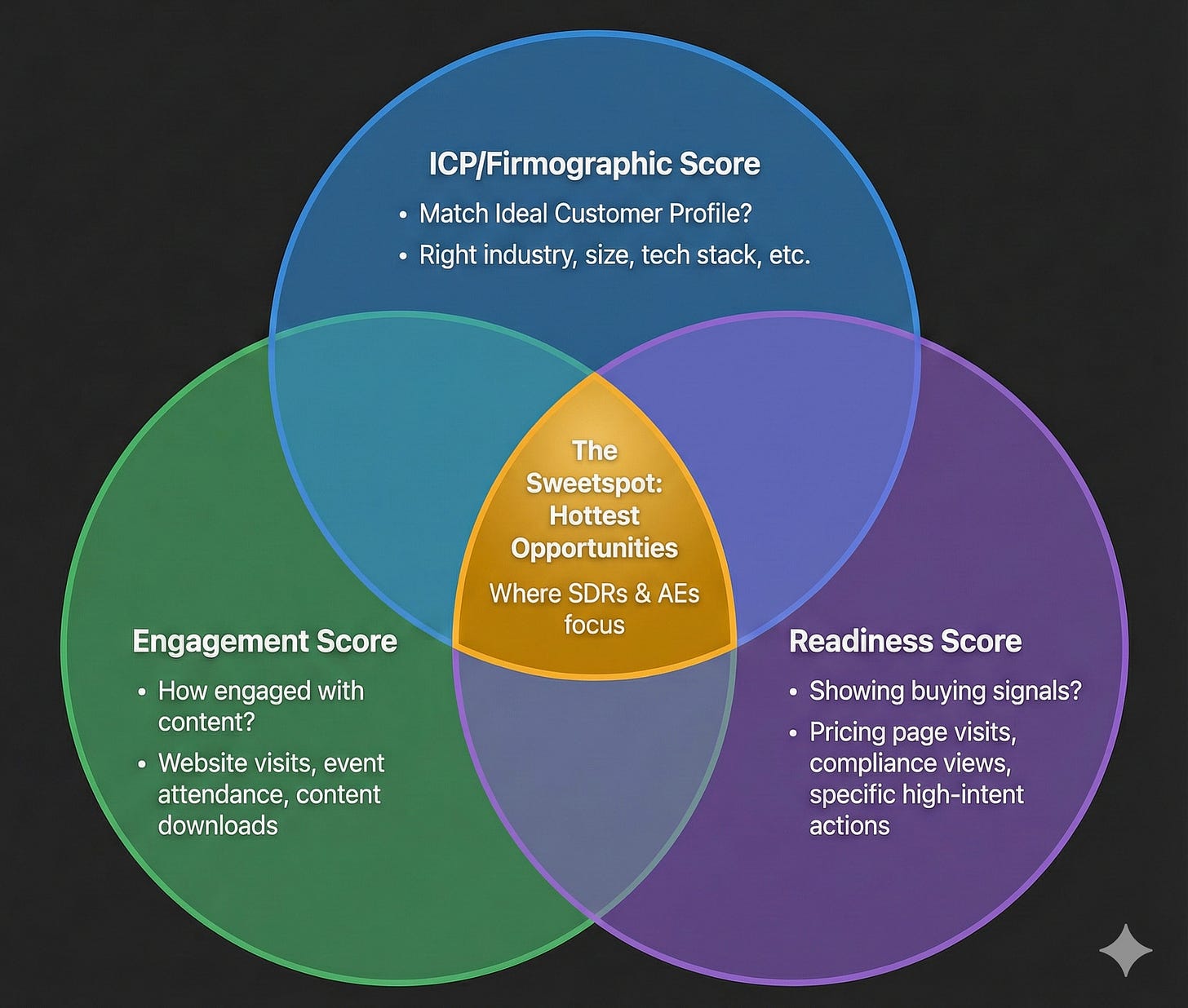

The three-circle overlap (ICP + engagement + readiness)

Soham shared a framework he’s used at multiple companies: a Venn diagram with three overlapping circles.

Circle 1: ICP/Firmographic/Technographic Score

Do they match your ideal customer profile?

Right industry, size, tech stack, etc.

Circle 2: Engagement Score

How engaged are they with your content?

Website visits, event attendance, content downloads

Circle 3: Readiness Score

Are they showing signals that they’re ready to buy?

Pricing page visits, compliance/security page views, specific high-intent actions

No individual circle is interesting on its own. The magic is in the overlap. The center of the Venn diagram is the sweetspot.

When you look at accounts that score high on all three—ICP fit, engagement, and readiness—you’re looking at your hottest opportunities. That’s where your SDRs should be spending their time. That’s where your AEs should start their pipe gen blocks.

Niche signals are the alpha (plus real examples)

Everyone’s using the same signals: job postings, website visits, LinkedIn engagement. Those are fine. But the alpha is in the niche signals. The creative signals specific to your business that competitors aren’t tracking.

My Turing test for a good signal: If someone inside the company describes a signal to you (an outsider) and I don’t even know what the words mean, it’s probably a good one. :)

Example 1: Terms of service updates

I worked with a company in the data compliance space. One signal we used was when a company updated their terms of service page.

I had no idea this was even a thing, much less trackable (scrapeable). But when companies update their terms of service, they legally have to notify all their users. People write in asking to be removed from lists. It creates a bunch of work.

This company helps handle that process. So when they detect a terms of service update, they reach out: “Saw you just updated your terms of service. We help with that whole process you probably just felt the pain of over the last two weeks.”

Out of 30,000 accounts in their ICP, 122 updated their terms of service last month. Those 122 get the outreach. Timing is perfect. Relevance is high.

Example 2: Technical documentation paths

At Weaviate (AI/vector database company), Soham saw a strong correlation between visitors to technical documentation and deal outcomes.

So, he would create pathways within technical docs to understand if there’s a correlation between people going from doc A → B → C. Does that pattern tell you something about an incumbent tool they’re using? Or a specific part of your product they’re struggling with?

Example 3: New restaurant locations

Soham mentioned Kyle from Owner (the final speaker at the AI x GTM Summit). When you’re selling to SMB restaurants, how do you even figure out where they’re at?

Now you can detect when a new location opens. You can figure out if surrounding restaurants have foot traffic. You can find correlations between types of restaurants and success patterns.

Five years ago, this was impossible without lots of manual work. Now you can build it with the cutting-edge tools.

Timing matters more than copy

Soham’s hot take (which I agree with completely):

“Mediocre AI copy can work if it’s landing at the exact right time.”

He gave a great example: if he got 20 emails after this webinar with the subject line “Loved your webinar,” he’d open all of them. Even if they were AI-generated. Even if there was no human in the loop.

But if those same emails arrived two weeks later? His likelihood of opening them drops dramatically.

Timing is the unlock.

How to find the right signals for your business

This was one of the most practical parts of the conversation. We discussed how you actually figure out which signals matter for your specific market.

Step 1: Talk to your best sellers.

Soham’s first move at any new company: talk to 5+ sellers. Ask them to walk you through recent deals. They may not realize they’re telling you about signals, but they are.

“Hey, this deal came in from this place. Then I looked up this thing. Then I sent 12 emails and a phone call finally worked...”

You can dissect a ton from that conversation.

I would also add that talking to the CEO and/or founders of the company will generate a bunch of good ideas, too.

Step 2: Ask what a great lead looks like.

Ask your top rep: “When you show up for a 30-minute demo, what does a great lead look like? What do you research before the call? What do you look for?”

They’ll tell you. And whatever they’re looking for—that’s a signal you can potentially automate.

Matthew also talked about this in session #1 of the summit.

Step 3: Backtest everything.

Soham’s caveat to the whole subject of signals was that they have to matter at the end of the day. They have to generate real pipeline. And eventually, closed deals. Not just vanity metrics like replies.

You can generate all the meetings you want. But if the signals aren’t converting to revenue, you need to re-evaluate and keep iterating.

Who owns this? (RevOps, GTM engineering, SDR leaders)

Here is Soham’s take on ownership:

RevOps sits at the top layer. They see across marketing, sales development, AE pipeline, post-sale, CS, account management, upsell, renewal—the whole lifecycle.

GTM engineering works under or closely with RevOps. They build the workflows and automations.

SDR leaders are the unsung heroes. The SDR role is two functions: research and outreach. AI and signals can 10x both. But you need to stay close to your SDR leader to figure out what to prioritize.

If you’re a RevOps person trying to do this alone without input from sellers and SDR leadership, you’re underwater.

Operationalizing signals without creating noise

Soham’s framework to operationalize and automate signals for every account:

Ignore completely. Some accounts just don’t deserve attention right now.

Warm outreach at scale. Marketing nurture, automated sequences.

Manual human effort. Real sales outreach from a rep.

What’s different now: you have AI-led options in the last two categories.

Marketing nurture can be AI-led (tools like Profound, AirOps for GEO).

Sales outreach can be AI-led SDR work or human-led SDR work.

On alerts:

Sales-led alerts make sense if you have a smart way to action them. But alerts just for alerts’ sake create noise.

You need to build the proper Salesforce architecture to track which alerts actually work. That’s the level of rigor required.

On prioritization:

It’s just as important to figure out what to cut as what to prioritize. Don’t try to touch everything with a marketing email just because you can.

Soham asks, “What are the 100 customers you’d be most proud to have won at the end of the year? Work backwards from there.”

Tool agnostic (start small, iterate quickly)

Soham’s closing advice was around being tool agnostic. Clay, Common Room, Sumble, etc. You can accomplish similar things with most of them. What matters more: understanding your problems and jobs to be done before you engage with vendors.

By the way, I agree. I think it’s important to avoid “gear acquisition syndrome.”

His approach:

Minimize vendor spin (it’s exhausting and isn’t critical)

Index on high velocity, high support, ability to pivot

Start with a couple signals, not a master doc of every signal on the planet (huge!)

Backtest with real results

Iterate quickly

“Start small, iterate quickly, always backtest with your real results and data. You can spin up a pretty good signal engine really quickly.”

The Bottom Line

Signals are powerful, but only if they’re the right signals for your specific business.

The commoditized stuff (job postings, website visits, LinkedIn engagement) is table stakes. The alpha is in the niche signals that are specific to your market, your product, and your buyers.

The formula:

Tier your ICP → Use AI to enrich and score accounts by fit

Layer signals on top → ICP fit + engagement + readiness

Find niche signals → Talk to your best sellers, mine their research process

Backtest everything → Real pipeline, real revenue, not vanity metrics

Start small → A couple signals, iterated quickly, beats a master plan that never ships

The 112 accounts in your “Signal-based market” today are different from the 94 accounts next week, and 133 the following week. That’s the point. Signals are dynamic. Your outreach should be too.

Timing is the unlock. Niche signals are the alpha.

Watch the full session on YouTube (23 minutes):

Grateful for Soham for sharing how modern RevOps leaders are building AI-native GTM machines today. If you’re thinking about signal-based selling, he’s one of the best operators in the space.

Follow Soham Maniar on LinkedIn.

→ Soham is currently at Nominal, building RevOps and GTM infrastructure for a hardware-focused company. Previously at Weaviate (AI/vector database), Mixpanel, AWS, Twitter, Bluewolf and others.

The final session summary of the AI x GTM Summit will be in your inbox next: Learn, Build, Scale: A Revenue Leader’s AI Transformation Roadmap, with Kyle Norton (CRO of Owner.com).

Thank you for your attention and trust,

Brendan 🫡

PS: Check out the sponsors that made this event possible: Rox, Attention, Clarify, Sumble, Instantly.