Welcome to each new member of The Signal! I’m grateful you’re here. If you haven’t already, join 1,000+ weekly readers—some of the smartest GTM operators—by subscribing here:

Hey y’all!

I hope everyone enjoyed the SuperBowl and watching Taylor’s boyfriend’s team win. Here is a twitter thread of the best SuperBowl memes (which, at this point, let’s be honest, is what it’s all about).

In other (B2B SaaS GTM Tech news)… SalesLoft just announced its acqusition of Drift. It will definitely help them expand into the Marketing use case with a really strong product offering that is differentiated from "The Big 6 Sales Tech Companies" (Apollo, Zoominfo, Gong, Clari, SalesLoft, Outreach).

Okay, let’s get into today’s post, it’s a bit unique.

First, the backstory on why I’m posting this…

After working on Groundswell for years, I wanted to share the top lessons we learned building this product. We worked with ~30 customers, and in the end, candidly - they liked us, but they didn’t love us.

So, in the spirit of transparency, my co-founder and I decided to publish a public “post-mortem.”

Why share? Because I believe in playing long-term, positive-sum games.

In a longterm game, it’s positive sum. We’re all baking the pie together. We’re trying to make it as big as possible. And in a short term game, we’re cutting up the pie.

-Naval

^ Excerpt Naval’s essay: Play Long-term Games With Long-term People | All returns in life come from compound interest in long-term games

I hope that sharing what we learned will help some founders and/or operators avoid a few of the pitfalls that we ran into over the last few years building Groundswell.

What we learned building Groundswell

Co-authored by Hari Nayak

We still think this product should exist, but we have come to the conclusion that this is only possible to build within a greater “platform” (or as a compound startup).

Before going into the top things we learned, we wanted to give a bit of context on how we got to where we are today.

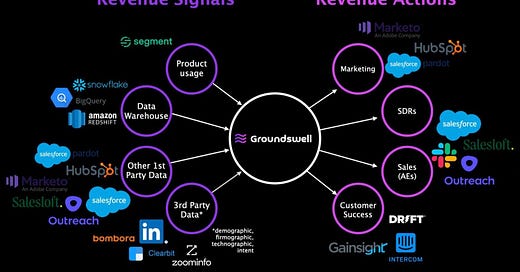

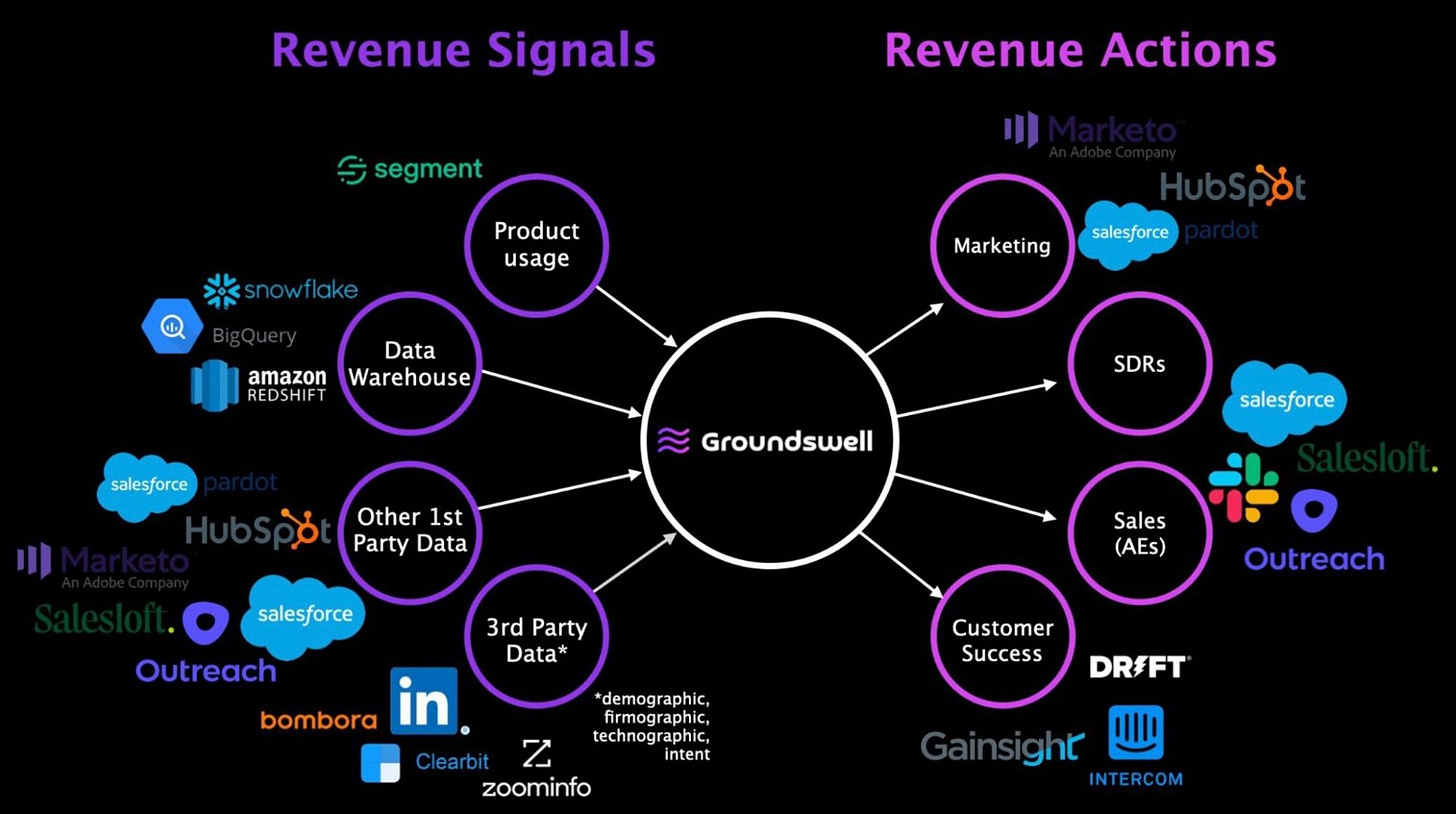

Our original vision → “The Brain for Revenue Teams”

We set out to build The Brain for Revenue Teams.

What is “The Brain for Revenue Teams?” This:

Where we started (our wedge) → a “product-led sales platform”

We decided to start with product usage data (the top “bubble” in the graphic above) for the following reasons:

We believed (and still do believe) that if you’re a PLG company, product usage is the highest intent signal there is for SDR/Sales Teams for targeting (and for Marketing and CS Teams, for that matter)

As founders, our most recent experiences gave us a unique advantage to build here (Brendan was at Zoom, Hari was at StreamSets - both were perfect examples of PLG companies that struggled to operationalize product usage data for the GTM Team)

It seemed like the obvious wedge in 2020, when we made this decision because A) VCs invested lots of money ($10s of millions) in over a dozen early-stage companies in the “PLG CRM” space, B) people were writing lots of articles (here, here, and here) to build out a category around PLG/PLS, and C) “message-market fit” was a rocket ship around the education of PLG/PLS (here and here); said another way, PLG was very promising

We had to start somewhere, we couldn’t boil the ocean; and the other “bubbles” were solved problems with point solutions already (so there less of an opportunity to build novel IP in these categories)

What we learned over the past 2+ years

Product usage data is a great feature, but not suited for a standalone platform

We believe that it would be more practical to incorporate product signals and related actions into an existing signal-based selling platform as a product line. This is due to several reasons:

The market size for a company solely focused on operationalizing product usage data is relatively small and may not be sustainable. Only a few large companies have enough free users to create a reliable pipeline.

It is more logical for an existing sales platform to introduce product usage signals into their stack, instead of us adding all other signals. Consolidation is becoming a common trend in the market - by joining a bigger platform, we can build a company that is part of a more comprehensive platform.

Very few companies have data in an analytics-ready state

Most companies have lots of data in their cloud data warehouse, but it’s not in an “analytics-ready state.” Meaning, it’s not ready for a platform to have a UI simply sitting on top of it.

We started with Segment, which sends data in a very predictable way. But as we moved up-market, we found that the majority of product data (and other necessary and/or helpful data) was sitting in their data warehouse. And it turns out that getting that data ready to use takes many months (in the best-case scenario) and a lot of coordination/buy-in from the data engineering team. Even our direct competitors who have lots more resources aren’t able to onboard customers in less than 6+ months.

The owner of “product-led sales” is still very unclear, making it hard to sell and implement a PLS solution

Executing Product-Led Growth and Sales is a complex undertaking that requires a deep understanding of the approach. Unfortunately, very few companies have the clarity and foresight to carry it out effectively. The majority of the customers we work with:

Do not have a clear owner and alignment among teams.

Do not have well-defined criteria that all GTM teams agree on and optimize for.

Do not have analytics-ready data.

To successfully implement PLS, educating the market on its requirements and supporting customers during implementation is crucial.

Small TAM → A PLS platform works best for companies with large install bases (and there are only a limited number of these companies)

Our goal was to identify qualified buyers among a large pool of free users for PLG companies, which was like finding a needle in a haystack.

However, we discovered that many companies did not have enough free users to generate a significant number of qualified leads for their sales teams. This was true for most of the 20 companies we worked with.

In other words, there is a ceiling to the value we can add.

Therefore, our customers first needed to acquire more users through marketing and sales outbound efforts, before we could add value. We often found ourselves trying to help our customers with outbound efforts by utilizing various signals in addition to operationalizing their product usage data.

We think that the number of PLG companies will grow significantly over the next 3-5 years, but we may just have been a bit early (”There are no bad ideas, only bad timing”).

A DIY solution to operationalize product-usage data is “good enough” for most companies

Most companies can use reverse-ETL or a BI tool and get 80% of the way there, and that’s good enough for them.

Before we started the company, we did nearly 100 customer interviews (not hyperbole), that’s a lot! We hustled to get these conversations set up. And in hindsight, one of the most common takeaways with those conversations was “we know this is a problem, so much so that we’ve built a solution internally, using reverse-ETL+CRM or leveraging a BI Dashboard.” To me, this was the opportunity — this was the “real estate” to replace with something like Groundswell. But I think, in reality, those solutions were “good enough” for the remaining juice that can be squeezed out of a product usage data.

If you made it until the end, and found it valuable - the best thing you can do is like/comment/repost my LinkedIn post.

Thanks for reading and learning with me. 🫡

See you next week,

B.